vermont income tax rate 2021

Vermont Tax Brackets for Tax Year 2021 2021 Tax Brackets and Income ranges will be listed here as they become available. However this does not influence our evaluations.

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

We last updated Vermont Form MVB-613 in October 2022 from the Vermont Department of Taxes.

. RateSched-2021pdf 3251 KB File Format. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Meanwhile total state and local sales taxes. New York state income tax rates are 4 45 525. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married.

Our opinions are our own. Print This Form More about the Vermont Tax Rate Schedules Individual Income Tax TY 2021 We last updated the Income Tax Rate Schedules in March 2022 so this is the latest version of Tax. Empire State Child Credit - 33 of the federal child tax credit ot 100 for.

Your average tax rate is 1198 and your marginal tax rate is. Erie County Real Property Tax Services Edward A Rath County Office Building 95 Franklin Street - Room 100 Buffalo New York 14202 Tax Line. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60.

Here is a list of our partners and heres how we make money. The state applies taxes progressively as. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income. Tuesday January 25 2022 - 1200. Vermont Income Tax Calculator 2021 If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

Vermont State Income Tax Tax Year 2021 11 - Contents Vermont Tax Rates Vermont Tax Calculator Tax Deductions Filing My Tax Return Vermont Tax Forms Mailing Addresses eFiling. New York States top marginal income tax rate of 109 is one of the highest in the country but very few taxpayers pay that amount. Tax Rate Filing Status Income Range Taxes Due 335 Single.

Massachusetts Sales Tax Rate Rates Calculator Avalara

State By State Guide To Taxes On Middle Class Families Kiplinger

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Vermont State Tax Guide Kiplinger

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

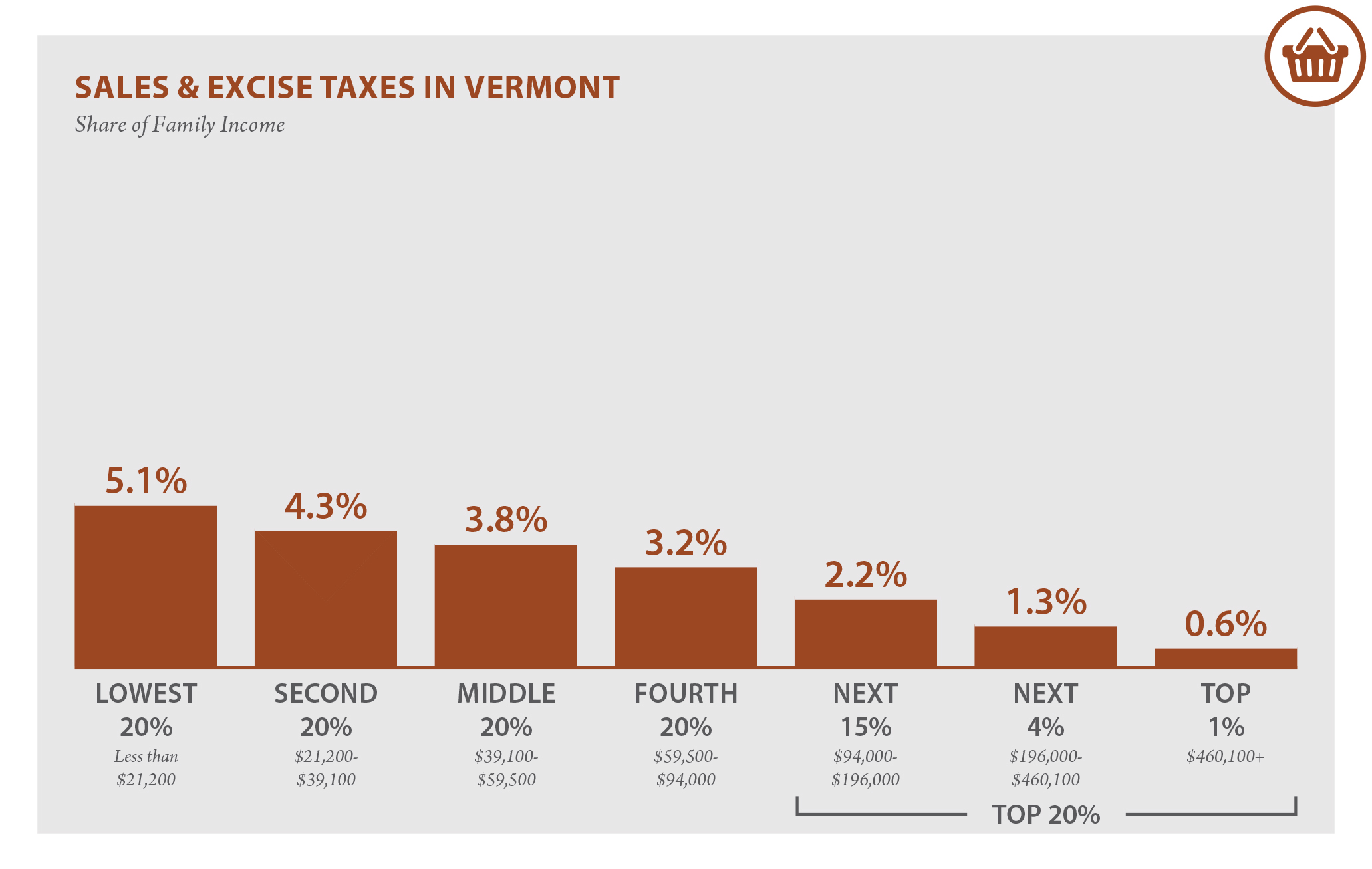

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Calculator Smartasset

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

The Most And Least Tax Friendly Us States

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

State Sales Tax Rates 2022 Avalara

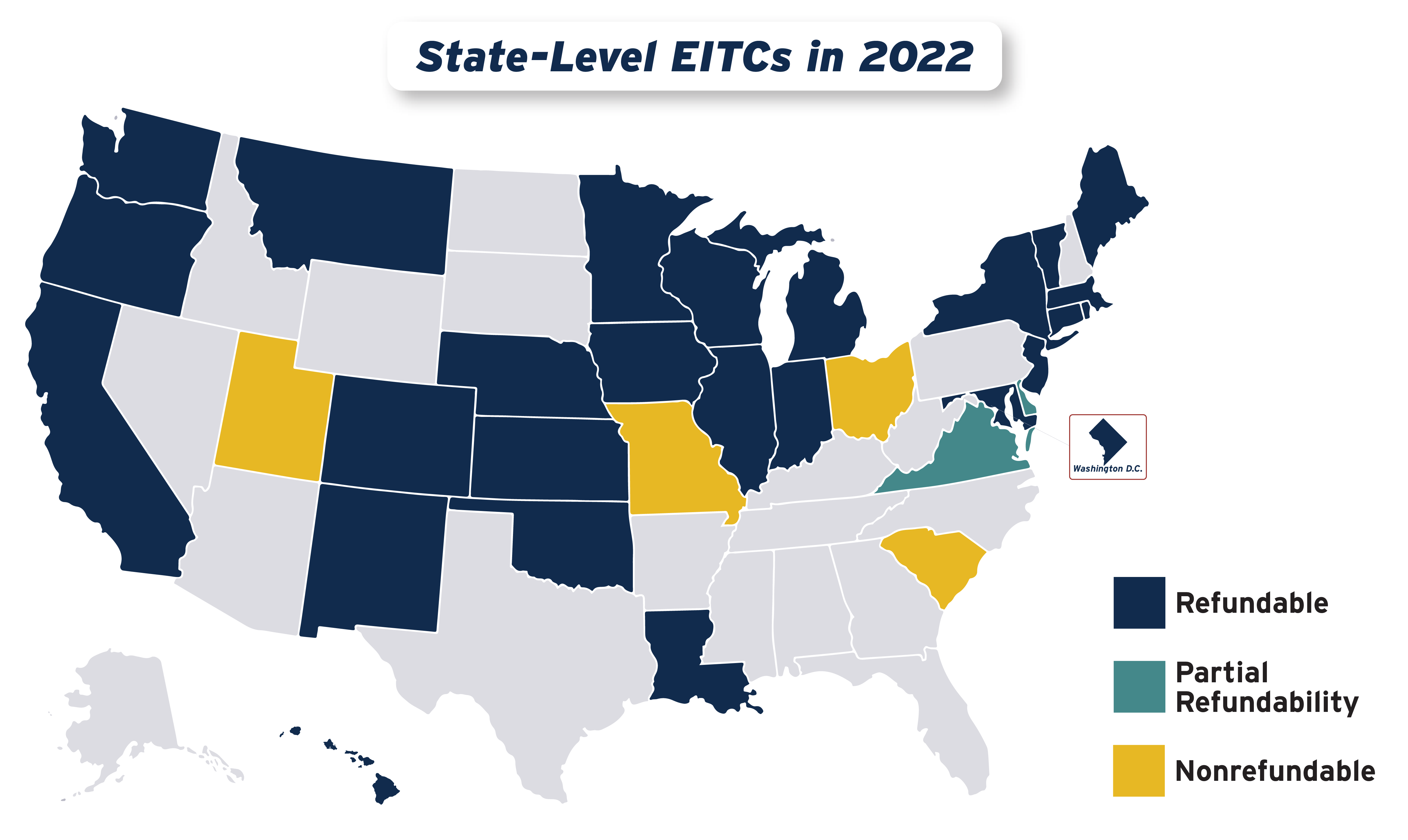

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

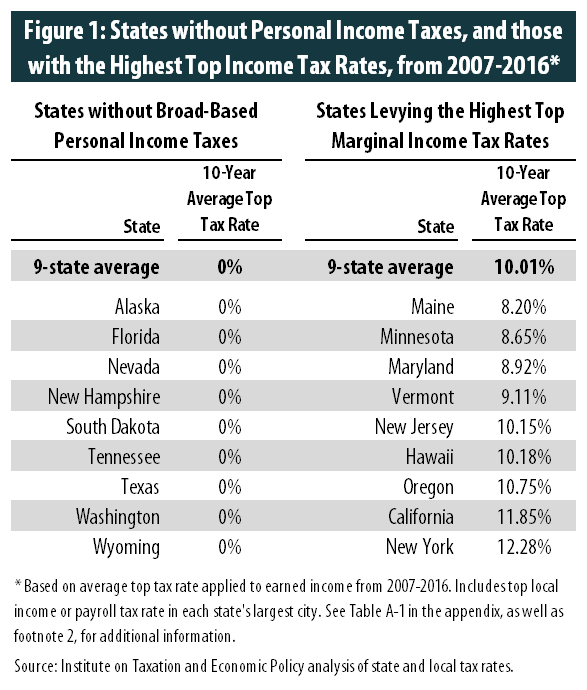

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy